AN ELDERLY man claims his bank failed him after he was scammed out of his life savings.

Kosmo Alexandrou, 76, is calling out Chase Bank for failing its “duty of care” to protect him from a scam that resulted in him losing $142,500.

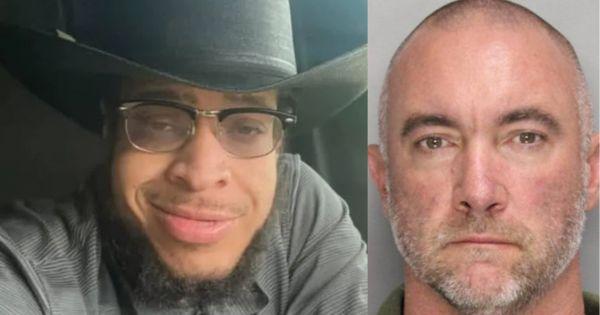

Kosmo Alexandrou, 76, said he felt ‘betrayed’ by Chase after losing his money to an online scamCredit: Kosmo Alexandrou

Chase sent Alexandrou a letter claiming he approved the $142,500 wire transfer to a cryptocurrency accountCredit: Getty

Chase told Alexandrou that it is still investigating his claimsCredit: Getty

In May 2023, the New Jersey man was on his laptop when he received a notification that his information had been compromised, NJ.com reported.

The message instructed Alexandrou to contact the number listed on the pop-up. Once he dialed the number, a man picked up and told Alexandrou that his Chase bank account had also been compromised.

After several phone calls, the scammers convinced the 76-year-old to transfer all of his money from his Chase account into a cryptocurrency account which would be set up in his name.

A police report of the incident stated that Alexandrou did not give the scammers any of his personal information but that they mysteriously had it already.

Immediately after the New Jersey man realized he had been taken advantage of, he reported the fraud to Chase. The letter that he received three weeks later shocked him more than anything.

Chase initially denied Alexandrou’s fraud claims on May 24.

Alexandrou appealed the decision on June 22, citing Regulation E of the Electronic Funds Transfer Act, which protects banking customers from unauthorized electronic transfers.

Chase refuted the dispute, claiming that the wire was sent based on Alexandrou’s instruction. “Our Retail Fraud team contacted you about the wire transfer,” the letter said.

“You advised them the wire was valid as your financial consultant suggested the cryptocurrency investment, you advised you were the beneficiary of the investment account, and you were comfortable sending the wire.”

Alexandrou told NJ.com that no conversation ever took place between him and a legitimate Chase representative.

“How ludicrous is it that I, a 76-year-old, would transfer my life savings to a cryptocurrency account?”

When pressured for the alleged audio recording between Alexandrou and the Chase representative, the bank informed the Chase customer that he would need to obtain a subpoena to access the recording.

“This story isn’t about me being scammed. I am sure I am one of millions who have fallen victim to computer fraud, and I am embarrassed about this,” Alexandrou said.

“This story is about how Chase Bank failed in their duty of care and internal controls, allowing a fraudulent transfer of my life savings without proper safeguards.”

Chase told Alexandrou that it was still investigating his claims, but the scam victim said he still feels betrayed by his bank.

“I feel that someone took a knife and stabbed me in the back,” he said. “And now that the bank isn’t going to do the right thing, I feel even more betrayed.”

The U.S. Sun contacted Chase for comment, but the bank did not immediately respond.

PROTECT YOURSELF

In 2024, nearly 80 million Americans reported losing money to scams, Feature Space reported.

To help prevent users from falling for more scams, the Federal Deposit Insurance Corporation (FDIC) shared some tips on how to spot an online scam.

According to the FDIC, users should be wary of emails from unknown senders, use strong passwords, keep their software up to date, and be sure never to share any personal information.