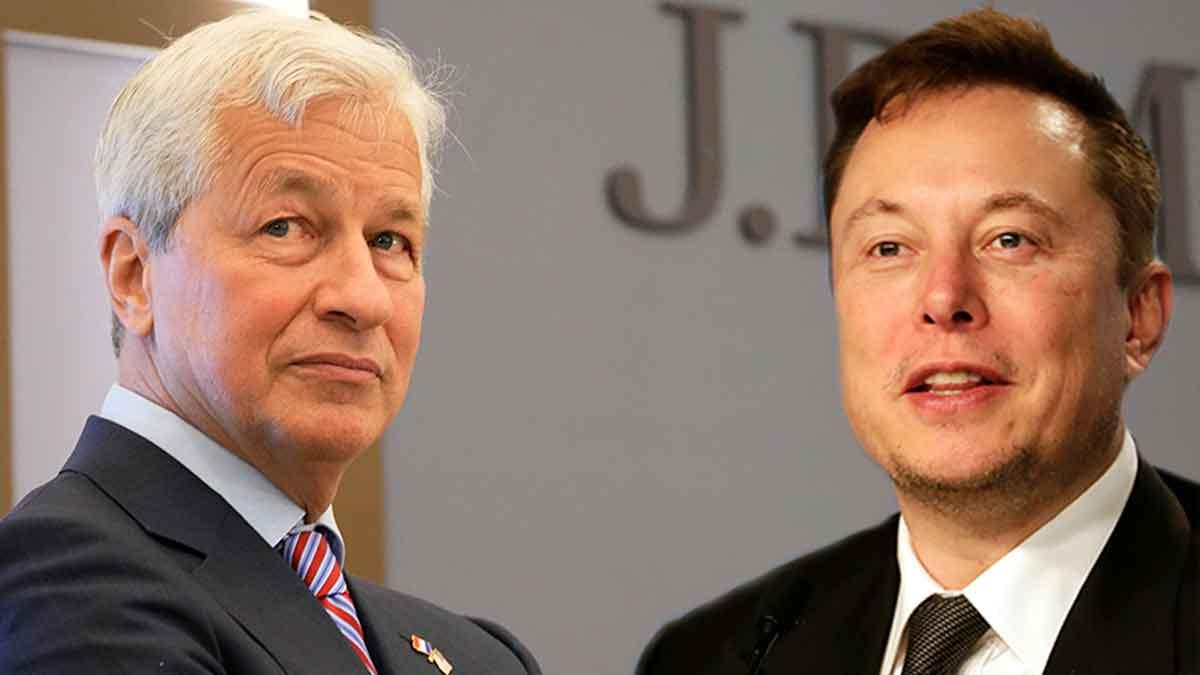

- Elon Musk and Jamie Dimon may be mending their nearly decade-long feud.

- Their strained relationship dates back to 2016, when JPM walked away from underwriting Tesla leases.

- Musk and Dimon recently talked on stage together at a JPMorgan summit.

Elon Musk and Jamie Dimon seem to be putting a nearly ten-year feud behind them.

The Tesla and JPMorgan CEOs have been throwing remarks — and lawsuits — at one another since 2016. But their relationship has been better since March, people familiar with the duo told The Wall Street Journal.

In March, Musk attended a JPMorgan technology summit in Big Sky, Montana, and the two executives spoke for an hour on stage about artificial intelligence and politics, the Journal reported. Musk also visited Dimon’s suite at the resort and stayed there for over an hour.

Following the event, Dimon decided his bank could try to go back to doing business with Musk, people familiar with the event said. A patch-up would be a win-win: Musk would get access to funding and advisory from the biggest bank in the US, and JPMorgan would have a chance to work with the serial entrepreneur’s many businesses.

The relationship first turned sour in 2016 when the investment bank walked away from underwriting leases for Tesla’s cars. Its bankers didn’t know how to value the lifespan of the electric vehicle’s batteries. That made Musk mad. He called the bank’s head of consumer banking, cursed, and threatened to pull Tesla’s business. Dimon called back and said that his bank would not be bullied, the Journal reported.

From then, Musk really did take his business elsewhere. He has relied more on Goldman Sachs and Morgan Stanley, which were already Tesla’s primary advisors. Goldman helped take the carmaker public in 2010 and was Musk’s first choice when he attempted to make the company private again in 2018. According to financial data company Dealogic, Goldman has been paid nearly $90 million in fees from Tesla and SpaceX, another Musk venture, since 2010.

To make matters worse, JPMorgan sued Tesla and Musk over $162 million in 2021. The bank said Tesla “flagrantly” breached a 2014 contract the two companies signed relating to warrants sold to the bank. JPMorgan said Musk’s tweet talking about taking the company private messed up the market. Tesla countersued, saying the bank was angry because it was left out of Musk’s business and JPM executives had “animus” toward their boss.

In November, Dimon spoke about the lawsuit at a New York Times conference and said: “We think we’re owed money for something and they say no, and it’s in court and we’ll win.”